The Dangerous Allure of the High-Flyer

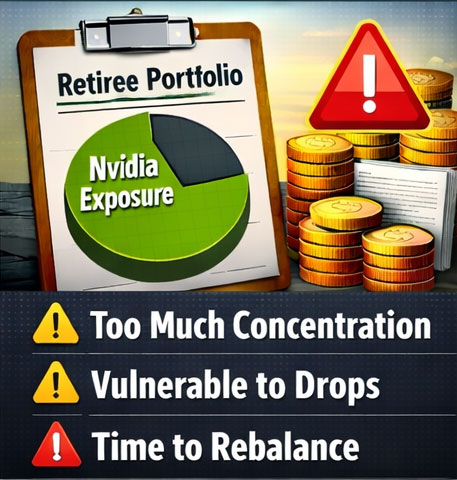

If you’ve been watching the headlines lately, it feels like every financial “guru” is shouting from the rooftops about artificial intelligence. It’s the new gold rush, and the king of the mountain is Nvidia. If you bought in a few years ago, you’re likely sitting on gains that look incredible on paper. But there’s a massive difference between being a “market winner” and having a secure retirement. Most people don’t realize that a portfolio heavily weighted in tech is basically a ticking time bomb once you stop receiving a paycheck.

Most retirees I talk to are caught in a classic trap. They see the Nvidia AI stock market risk as something that only applies to other people—until the floor falls out. I’ve seen this movie before. In 2008, I watched an advisor run around like a chicken with his head cut off while his clients’ life savings evaporated in real-time. He had no plan for a down market. He just kept telling people to “hang in there” while their dignity was being drained by a 40% loss. I decided right then that I would never be involved in losing a client’s money. Ever.

When you’re in your 30s, a 20% drop in a tech stock is a “buying opportunity.” You’ve got time to wait for the bounce. But when you’re 65, that same drop is a threat to your ability to pay for groceries or keep your home. You don’t have twenty years to wait for a “recovery” that might never come. Wall Street wants you to “buy and hold” because they collect their fees regardless of whether you’re winning or losing. But in the real world, hope isn’t a strategy. It’s a gamble you can’t afford to lose.

The Hidden Fees Eating Your Gains

One of the biggest injustices in the financial world is the “silent killer”: advisor fees. I remember looking at my mother’s investment statements years ago. My father had passed away at just 45, and my mom—who hadn’t worked in two decades—was forced back into a minimum-wage job. It was heartbreaking to see her struggle. Even though her modest investments were showing some growth, every penny of that interest was being eaten alive by “management fees.” The advisor was getting paid while my mom was barely keeping her head above water.

We champion the underdog retiree because the system is rigged.

That’s why we operate with a No Advisor Fee Guarantee. If your advisor is taking 1% or 2% of your total assets every year, they’re building their retirement by taking from yours. Think about it: if the market is flat, you lose money because of the fee. If the market goes down, you lose even more. We flipped that model on its head. We’re paid by the institutions, not by taking a bite out of your principal. This ensures that your money stays where it belongs—in your pocket.

Guarantees Over “Potential” Returns

The traditional “AUM” (Assets Under Management) model is built on possibilities and “what-ifs.” They tell you what might happen if the AI boom continues forever. At Retirement Renegade, we trade “possibilities” for contractual guarantees. We use a Safe Income Strategy that prioritizes principal protection above everything else. We don’t care about beating the S&P 500 if it means risking the money you need to survive.

We lean heavily into hybrid contractual products. These aren’t the clunky annuities of thirty years ago that your grandfather might have hated. These are modern, multi-dimensional tools that offer a level of safety that the stock market simply cannot match. When you move your money into these vehicles, you get:

-

Zero Market Risk: When the market drops, you don’t lose a cent. Your floor is always zero.

-

Guaranteed Paychecks: A monthly income stream you can never outlive, regardless of what happens in Washington.

-

Free Long-Term Care: Protection for your health without the massive premiums that usually come with it.

I call this the “Multi-Dimensional Approach.” It’s about building a fortress around your wealth so that Washington’s tax hikes or a sudden tech bubble burst can’t touch your lifestyle. Most advisors won’t tell you about these because they don’t get to charge you that 1% annual fee to manage them. They’d rather keep you in the “risk zone” so they can keep their recurring revenue.

The Relationship Sit-Down

We don’t do high-pressure sales pitches or fancy steak dinners designed to trick you into signing papers. We do what I call the Relationship Sit-Down. We listen first. We want to know what keeps you up at night. Are you worried about the Nvidia AI stock market risk dragging down your S&P 500 index fund? Are you scared of running out of money before you run out of life? We take the time to hear your story because every “underdog” has a different set of challenges.

We use books, films, and educational “movie sessions” to show you exactly how the plumbing of the financial world works. You deserve to be an educated guide of your own future, not a passenger in someone else’s fee-driven vehicle. We give you the “Renegade” perspective—the unfiltered truth about where your money is actually going and how much it’s costing you to stay in the traditional market.

The Looming Storm and Your Exit Strategy

The reality is that we are entering a period of massive uncertainty. Between the national debt, potential tax hikes, and the instability of Social Security, retirees are facing a “perfect storm.” If you’re sitting on a pile of tech stocks like Nvidia, you’re essentially standing in the middle of an open field during a lightning storm holding a metal rod. You might get lucky, but the risk-reward ratio is completely out of whack.

You need an exit strategy that moves you from the “Red Zone” of risk into the “Green Zone” of safety. This isn’t about being boring; it’s about being smart. When you have a guaranteed income, you have the freedom to enjoy your retirement without checking the ticker tape every morning. You can travel, spend time with grandkids, and live your life because the “math” is already solved.

Don’t Let the AI Bubble Burst Your Retirement

Nvidia is a great company, but it’s currently trading at valuations that assume everything will go perfectly forever. As a Retirement Renegade advocate, I can tell you that “forever” is a long time in the stock market. Bubbles always look like “the new normal” right before they pop. You’ve worked too hard and sacrificed too much to let a market correction send you back to work like my mother had to.

If you’re ready to stop gambling and start planning, you should secure a no-market-risk retirement today. It’s about more than just numbers on a screen; it’s about the peace of mind that comes from knowing your paycheck is backed by a contract, not a trend. Wall Street has enough money. It’s time you kept more of yours.

You deserve to retire with more than just your dignity. You deserve a plan that is battle-tested and built on a personal promise. Let’s sit down and see if we can get you to the finish line without the stress of the “next big thing” blowing up your nest egg. We don’t just manage money; we protect legacies. It’s time to join the rebellion against the status quo and take control of your financial future before the market makes that choice for you.