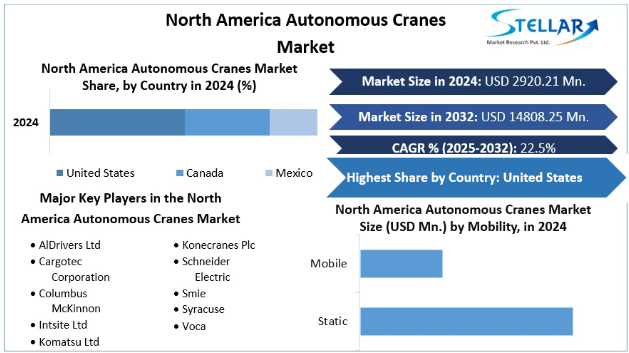

North America Autonomous Cranes Market was valued at USD 2920.21 Million in 2024. North America Autonomous Cranes Market size is estimated to grow at a CAGR of 22.5% over the forecast period.

Market Estimation & Definition

Autonomous cranes are advanced lifting systems that incorporate robotics, artificial intelligence, sensors, and control systems to enable partially or fully unmanned operation. These cranes are increasingly used across construction, mining, marine, and logistics sectors to improve efficiency, reduce labor dependency, and enhance on-site safety.

In 2024, the North American market was valued at USD 2.92 billion. By 2032, it is expected to reach USD 14.81 billion, driven by both organic growth in construction and retrofit opportunities across industrial sectors. The forecast leverages both historical data and future adoption models, analyzed using top-down and bottom-up methodologies.

Market Growth Drivers & Opportunities

A. Increased Emphasis on Safety and Productivity

With rising concerns over job site safety, companies are shifting toward automated crane solutions that minimize human exposure to hazardous conditions. Autonomous cranes reduce fatigue-related accidents, offer more consistent performance, and enable 24/7 operations with fewer delays.

B. Technological Advancements

Integration of AI, machine vision, real-time telemetry, and sensor fusion has elevated the performance capabilities of autonomous cranes. These technologies enable precision load handling, dynamic path planning, remote diagnostics, and predictive maintenance—all contributing to enhanced operational efficiency.

C. Infrastructure and Mega-Projects

Governments across North America are investing heavily in infrastructure upgrades, transport terminals, and urban development. This is creating large-scale demand for construction equipment that can operate faster, more safely, and with reduced manpower.

D. Expansion in Mining and Marine Applications

The mining and offshore sectors, which often involve remote and dangerous working conditions, are turning to autonomous cranes for safe material handling. These cranes offer higher control in difficult terrains and deliver improved load optimization.

E. Retrofitting and Aftermarket Growth

A significant opportunity lies in upgrading existing crane fleets. Retrofitting legacy equipment with autonomous modules and control systems enables organizations to modernize without full equipment replacement, offering a cost-effective path to automation.

Segmentation Analysis

The market is segmented based on business model, crane type, and end-user application.

By Business Type

-

OEM (Original Equipment Manufacturer): Focused on purpose-built autonomous crane systems integrated with smart technologies from the outset.

-

Aftermarket: Encompasses retrofitting kits, software upgrades, and hardware modifications for existing crane systems.

By Crane Type

-

Static Cranes: Includes tower cranes and gantry cranes typically used in fixed locations such as ports and industrial yards.

-

Mobile Cranes: Includes truck-mounted, crawler, and all-terrain cranes capable of operating across diverse job sites. Mobile cranes currently dominate the market due to their adaptability and broad application scope.

By End-User Vertical

-

Building & Construction: Leading segment, with widespread deployment of autonomous cranes for material handling and structural assembly.

-

Marine & Offshore: Increasing adoption for port container handling and offshore rig operations.

-

Mining & Excavation: Autonomous cranes are used for heavy lifting and ore transport in remote and hazardous mining locations.

Country-Level Analysis: United States & Canada

United States

The United States holds the lion’s share of the North American autonomous cranes market. With a surge in national infrastructure programs, including highways, bridges, ports, and urban development, the demand for efficient and safe lifting equipment is escalating. U.S.-based manufacturers and construction giants are actively deploying autonomous crane fleets to accelerate project timelines while addressing labor shortages.

Additionally, the rise of smart ports and digital logistics hubs in states like California, Texas, and Georgia is driving increased use of autonomous cranes in container handling and intermodal transport.

Canada

Canada is seeing strong adoption of autonomous cranes in the mining, construction, and remote development sectors. Harsh climates, vast unpopulated regions, and labor availability challenges make autonomous cranes especially valuable. The government’s support for industrial digitization and remote operations is further accelerating the trend toward autonomous equipment across resource-intensive sectors.

Commutator Analysis

Traditional cranes relied heavily on mechanical commutators in electric motors to manage current flow. However, modern autonomous cranes use brushless motors controlled by sophisticated power electronics, rendering mechanical commutators obsolete.

Key features of current systems include:

-

Electronic Commutation: Replaces mechanical parts with software-controlled inverters, increasing motor lifespan and reducing maintenance.

-

High-Precision Control: Enables real-time torque and speed modulation for safer and more efficient lifting.

-

Energy Efficiency: Integration of regenerative braking and optimized load balancing reduces energy consumption.

-

Advanced Drive Systems: Use of high-performance semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN) enhances switching efficiency and thermal stability.

This technological evolution underscores the transformation from legacy hardware to highly responsive, intelligent control systems in modern crane operations.

Conclusion

The North American autonomous cranes market is entering a dynamic growth phase. With projections showing an increase from USD 2.92 billion in 2024 to USD 14.81 billion by 2032, the sector is poised for a major shift in how lifting operations are performed across construction, mining, marine, and infrastructure domains.

This growth is underpinned by pressing safety needs, rapid urban development, and the increasing sophistication of automation technologies. The United States leads in implementation, backed by robust government spending and a strong OEM presence. Meanwhile, Canada is carving a niche in remote operations and resource-heavy industries.

As the market matures, stakeholders will benefit from both original equipment innovations and retrofit opportunities, enabling greater operational flexibility and a smoother transition to automation.

About Stellar Market Research:

Stellar Market Research is a global leader in market research and consulting services, specializing in a wide range of industries, including healthcare, technology, automobiles, electronics, and more. With a team of experts, Stellar Market Research provides data-driven market insights, strategic analysis, and competition evaluation to help businesses make informed decisions and achieve success in their respective industries.

For more information, please contact:

Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656