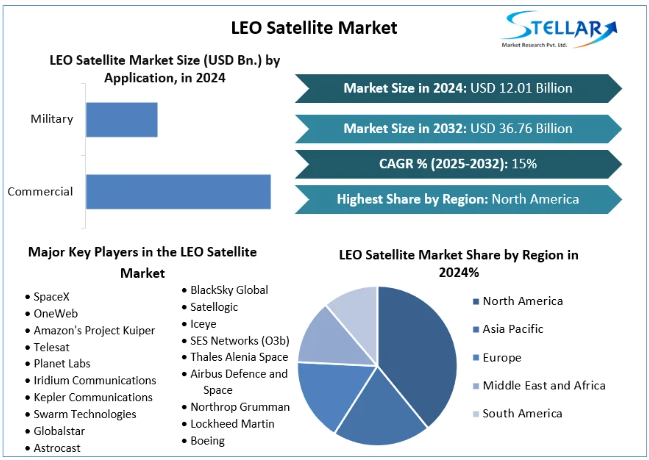

LEO Satellite Market size was valued at USD 12.01 Bn. in 2024 and the LEO Satellite revenue is expected to grow at a CAGR of 15% from 2025 to 2032, reaching nearly USD 36.76 Bn. by 2032.

Market Estimation & Definition

The Low Earth Orbit (LEO) Satellite Market is set to grow from USD 7.71 billion in 2024 to USD 11.53 billion by 2032, at a compound annual growth rate (CAGR) of 5.5%.

LEO satellites operate between 300 km to 1,200 km above the Earth’s surface. Their proximity allows faster data transmission (low latency), high-resolution imaging, and rapid revisit times. These features make them ideal for telecommunications, Earth observation, scientific missions, and government and defense applications.

The market is being reshaped by the proliferation of small satellites in megaconstellations—large fleets of satellites that can deliver global connectivity and persistent data coverage. These constellations are revolutionizing broadband access, particularly in underserved and remote regions.

Market Growth Drivers & Opportunities

Expansion of Megaconstellations

Large-scale satellite constellations launched by private tech giants and national programs are the primary growth drivers. These networks deliver high-speed internet across the globe, particularly in areas with limited terrestrial infrastructure.

Rural and Remote Connectivity

Governments and corporations are turning to LEO systems to bridge the digital divide. Satellite internet offers a scalable alternative to laying expensive fiber-optic cables, enabling inclusive digital transformation in developing and remote regions.

Government and Military Adoption

LEO satellites support secure communications, surveillance, intelligence gathering, and battlefield connectivity. Governments are investing heavily in LEO programs for defense and disaster response.

Earth Observation & Environmental Monitoring

LEO satellites are widely used for environmental tracking, agriculture monitoring, natural disaster detection, and climate science. Their ability to revisit specific locations frequently makes them ideal for time-sensitive data gathering.

Technological Advancements

The miniaturization of satellite components, emergence of electric propulsion, inter-satellite communications, and software-defined payloads are making LEO satellites more capable, affordable, and reliable.

Public-Private Partnerships

Government-backed initiatives are collaborating with private aerospace firms to build sovereign constellations, ensuring national security and resilience in space infrastructure.

Segmentation Analysis

By End Use

-

Commercial Sector: The largest and fastest-growing segment, contributing nearly 40% of total market share. Primary applications include broadband internet, satellite phones, and Earth imaging services.

-

Government & Military: High investments in secure communications, missile tracking, and satellite-based reconnaissance.

-

Dual-Use: Systems designed for both civilian and military applications are gaining prominence due to their versatility.

By Application

-

Communication: Dominates the market owing to rapid deployment of broadband LEO constellations.

-

Earth Observation & Remote Sensing: Second-largest application area. Widely adopted in agriculture, mining, meteorology, and urban planning.

-

Navigation & Scientific Research: Includes space weather monitoring, GNSS augmentation, and low-gravity science missions.

By Satellite Mass

-

Small Satellites (<500 kg): Represent the majority of LEO launches due to low cost, ease of manufacturing, and flexibility.

-

Medium Satellites (500–1000 kg): Offer a balance between payload and cost, often used for Earth observation and communications.

-

Large Satellites (>1000 kg): Less common in LEO but used for complex, high-capacity missions.

By Propulsion Type

-

Liquid Propulsion: Dominates due to its efficiency in orbital maneuvering and extended mission capability.

-

Electric Propulsion: Gaining popularity for being lightweight and fuel-efficient, especially in small satellite designs.

-

Others: Includes chemical propulsion and experimental systems such as solar sails.

By Region

-

North America: Holds the largest share of the global market, supported by advanced space infrastructure and major players.

-

Asia-Pacific: Fastest-growing region, with increasing space investments from China, India, Japan, and ASEAN countries.

-

Europe: Strong momentum driven by EU satellite initiatives and independent launch capabilities.

-

Latin America, Middle East & Africa: Emerging markets with growing interest in satellite-based internet and environmental monitoring.

Country-Level Analysis

United States

The U.S. is the undisputed leader in the global LEO satellite market. With thousands of active satellites in orbit, the country benefits from:

-

Large-scale deployments by private players offering broadband services globally.

-

Military use cases, including secure command and control networks, space surveillance, and tactical communications.

-

NASA and DoD collaborations on advanced research and national security systems.

-

Strong policy and regulatory support for domestic satellite manufacturing and launch services.

Germany

Germany is a key player within the European LEO ecosystem. Its strengths include:

-

Participation in EU-led satellite constellations, which focus on secure communications and climate monitoring.

-

Cutting-edge space research institutes and aerospace companies contributing to satellite design, testing, and integration.

-

Supportive government initiatives promoting dual-use space infrastructure, space situational awareness, and data analytics.

-

Germany’s focus on sovereignty, innovation, and environmental monitoring continues to strengthen its influence in the LEO sector.

Commutator Analysis (Competitive Landscape)

The LEO Satellite market is characterized by intense competition, rapid innovation, and diverse players including aerospace primes, tech giants, and emerging startups.

Key Players

-

Global Launch Providers: Firms that control rocket production and launch facilities maintain a strategic advantage.

-

Broadband Mega-Operators: Companies with large satellite fleets and customer bases dominate the communication segment.

-

Earth Observation Leaders: Specialized firms provide imaging, environmental monitoring, and geospatial intelligence services.

-

National Satellite Agencies: Agencies operating defense and scientific missions represent a stable and strategic segment.

Market Trends

-

Vertical Integration: Major players are integrating satellite design, manufacturing, and launch capabilities to reduce costs and improve speed to market.

-

5G & IoT Integration: LEO constellations are evolving to support direct-to-device connectivity and industrial IoT applications.

-

Software-Defined Satellites: Allow for dynamic reconfiguration of missions in-orbit, enhancing utility and lifespan.

-

Environmental Awareness: Growing attention on satellite debris management, orbital congestion, and sustainable launch practices.

Competitive Challenges

-

Regulatory Complexity: Licensing, frequency allocation, and international coordination remain hurdles.

-

Capital Intensity: High upfront investment is required for constellation deployment and operations.

-

Space Traffic Management: Collision avoidance and deorbiting strategies are becoming critical for safety and sustainability.

Press Release Conclusion

The LEO Satellite Market is undergoing a major transformation, driven by a surge in global connectivity demand, space commercialization, and strategic governmental investments. With a forecasted rise to USD 11.53 billion by 2032, the market is poised for robust, sustainable growth.

Countries like the United States are leading through commercial innovation and defense-backed deployments, while nations like Germany are positioning themselves as high-value contributors in the European space ecosystem. Small satellites and megaconstellations are reshaping how the world communicates, monitors the environment, and responds to emergencies.

Looking ahead, LEO satellites will be indispensable in delivering ubiquitous internet, geospatial intelligence, disaster readiness, and technological sovereignty. Stakeholders that align with emerging trends—such as direct-to-device communication, space sustainability, and AI-powered satellite operations—will be at the forefront of the next space revolution.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656