Managing finances is, in fact, one of the most important elements of most small businesses. Keeping track of payments and issuing invoices has traditionally been a manual exercise that can sometimes become quite overwhelming and lead to human error. More often than not, a small business owner would be multitasking, running a lot of other operations, and ending up spending precious time on billing tasks. The time could otherwise be spent on growing their business and focusing on customer service. This is where billing software comes into play-it really makes a difference in billing automation for small businesses with financial management, reduces human error, and can speed up the whole invoicing process.

This is a crucial consideration when it comes to the small businesses’ particular process of getting into billing software. In most cases, when a business just opens, it hardly has any clients, and even if it might have a couple of customers, manually handling such a task is pretty manageable. However, as your small business grows, so do the complexities associate with managing billing and invoicing. In short, billing software scales these operations without needing to hire another staff. Automates repetitive tasks, generates professional invoices, provides including detailed reports.

These are just some features that hold promise for a small business owner as not only do they improve accuracy, but they also allow small business owners to spend their valuable time on other issues such as marketing and customer engagement. It helps your small business stay organized and comply with tax laws, leading to better cash flow management and stronger customer relationships.

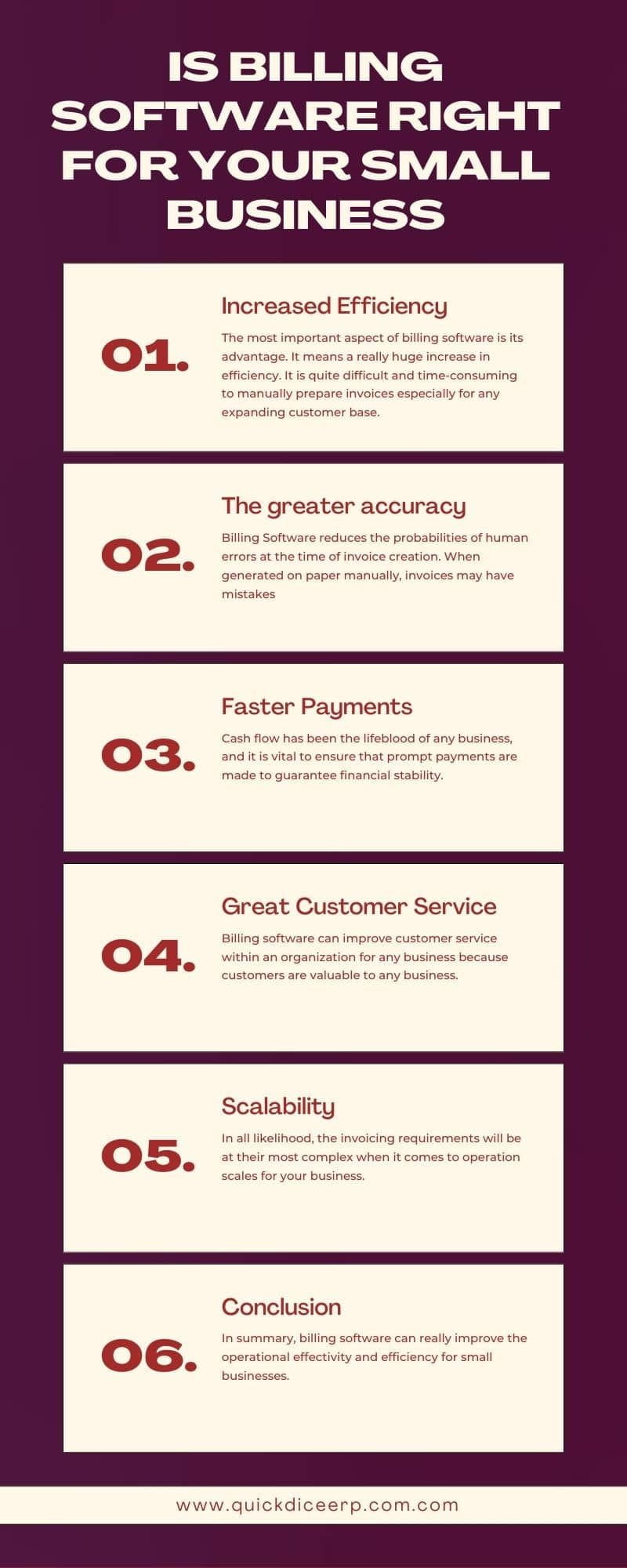

Here are Some of The Reasons Billing Software is Right For Your Small Business

Increased Efficiency

The most important aspect of billing software is its advantage. It means a really huge increase in efficiency. It is quite difficult and time-consuming to manually prepare invoices especially for any expanding customer base. Billing software automates invoice creation; when you enter the customer details into the system, you can generate invoices at one click. It avoids tedious and repeated works done by manual data entries and gives you more time to concentrate on other vital aspects of your business. Automated invoices ensure continuity because they utilize predefined templates to keep them all uniform.

Customer data will be stored and found easily so that it will not be necessary to enter customer’s data manually every time an invoice is to be generated. Billing software can also generate invoices in bulk, which makes it possible to generate invoices in bulk. That helps save more time. This increased efficiency would prove to be the lifeblood of small firms aiming to resource-fully run their daily operations.

The greater accuracy

Billing Software reduces the probabilities of human errors at the time of invoice creation. When generated on paper manually, invoices may have mistakes, be it in terms of totals or applying corrigendum on their tax rates or failing to include the smaller detail. Such debacles raise disputes and delayed payments, or sometimes even lead to customer dissatisfaction.

The software of billing automates all aspects of the process like tax calculation, total, and customer profiles. This gives a lower risk for mistakes and guarantees accurate invoices always. By getting rid of manual entry, you can have peace of mind knowing your bills are accurate, pricing, terms, and details correct. Accurate invoicing builds customer trust and makes sure your business is complying with local tax regulations.

Faster Payments

Cash flow has been the lifeblood of any business, and it is vital to ensure that prompt payments are made to guarantee financial stability. Billing software does indeed speed up the payment process by providing faster and more professional means of sending invoices. The days of waiting for an invoice to be printed, sealed, and mailed are over; invoices can now be sent instantly via electronic mail or integrated online platforms. This easy and quick delivery could lead to faster cycle payments, improving cash flow and reducing the time spent chasing overdue payments.

Another thing included in many billing software solutions is the online payment mode, enabling clients to pay directly from the invoice. Pairing this with secure payment gateways, such as credit card processing and bank transfers, invites customers to pay bills instantly and hastens payment.

Great Customer Service

Billing software can improve customer service within an organization for any business because customers are valuable to any business. One feature that is useful is that invoices created have a professional look including branding, which means including the company’s logo, colors, and contact details. In this way, the invoices feel more personalized to a customer and help establish the company identity, which improves how a client might perceive a company.

It also involves improving the quality of bills before sending them to clients by ensuring consistent formatting and error-free invoices, enhancing the overall customer experience. Another feature, automated reminders of overdue payments included in most billing software, helps contact clients in a professional manner without having to use manual means, and then your customers will always have a reminder to pay their dues on time while keeping a professional image for your business.

With the help of billing software, your invoicing process will no longer be merely automated-but an effective tool for offering revenue insights. Most of them have built-in reporting tools that allow real-time tracking of your business’s financial health parameters: outstanding invoices, cash flow, and sales trends- all rolled into one view.

Examples include being able to tell which clients owe bills at a glance and take necessary follow-up measures. Programs can generate reports on overall sales performance, helping businesses identify trends and make data-driven decisions.This financial visibility allows making wiser decisions about the growing business, competently managing cash flow, and resource allocation effectiveness.

Scalability

In all likelihood, the invoicing requirements will be at their most complex when it comes to operation scales for your business. But, the beauty of billing software is that it is scalable. Most modern billing software solutions are built to scale with your business. Whether it’s adding new customers, expanding into new product offerings, or tapping into new markets-billing software can easily keep pace.

Many billing systems provide an essential set of multi-currency features, invoice template configuration options, or the processing and management of complicated taxation rates to cope with business upscaling. Furthermore, with the increase of your clientele, billing software can enable you to address a more significant load of invoices without compromising efficiency or accuracy.

Conclusion

In summary, billing software can really improve the operational effectivity and efficiency for small businesses. For small business owners, the need to manage finances becomes vital to healthy cash flow and almost a gift from technology to allow automated billing. Billing software simplifies the invoicing process so that you may keep a check on the payments and reduce the chances of human error and delays in payment receipts. Billing software offers recurring billing, custom invoice templates, and integrates with accounting tools. It helps your business run efficiently, boosts professionalism, and enhances credibility with customers.

The other unique feature that actually makes this software the ideal tool for small growing businesses lies in its scalability. With the growth of the customer base, billing software requires neither additional resources nor complicated manual documentation in processing increased invoices. In addition, financial reports and real-time data produced by billing software provide valuable insights on the financial position of small businesses, enabling one to make good decisions. Billing software becomes a huge asset to a very small business, whether it is a sole proprietorship or a commercial company, allowing for the sole operator to concentrate on the projections for growth while ensuring that the billing and accounting processes are very low.