For any business—whether a startup, small enterprise, or an established company—access to timely funding is crucial. From buying inventory to upgrading equipment or managing cash flow, a business loan can help bridge the financial gap. But with so many lenders offering different products, selecting the best business loan provider can be overwhelming.

Choosing the right lender impacts not just your loan terms but also your financial stability and growth potential. In this blog, we’ll break down everything you need to consider to make an informed, smart decision.

1. Understand Your Business Needs

Before even looking for lenders, take the time to evaluate why you need the loan. Common purposes include:

- Purchasing equipment or machinery

- Expanding operations or hiring staff

- Managing seasonal cash flow gaps

- Launching new products or services

- Renovating office space

- Working capital requirements

Understanding your loan purpose helps you determine the ideal loan amount, tenure, and repayment capacity—which are essential for comparing offers effectively.

2. Check the Lender’s Reputation

A reliable business loan provider should have a strong track record. Look for:

- Customer reviews and testimonials

- Ratings on platforms like Google or Trustpilot

- Market experience and longevity

- Regulatory certifications (RBI approval for NBFCs, for instance)

Lenders with transparent operations and positive customer feedback are more likely to provide a smooth and trustworthy experience.

3. Compare Interest Rates

Interest rate is one of the most important factors that determine the cost of your loan. Even a small difference in rates can have a significant impact on your total repayment amount.

Key things to consider:

- Fixed vs. floating interest rates

- Annual Percentage Rate (APR) vs. flat interest rate

- Whether the lender charges daily, monthly, or annual interest

Choose a loan provider that offers competitive rates aligned with your credit profile and business performance.

4. Assess Loan Terms and Repayment Flexibility

Every business has different cash flow patterns. Flexible repayment options are essential for avoiding financial stress. Look for lenders who offer:

- Adjustable EMIs

- Grace periods or moratoriums

- Prepayment options with low or no penalty

- Multiple tenure choices (short-term vs. long-term loans)

The best business loan providers give you the freedom to align repayment with your business cycle.

5. Review Eligibility Criteria

Different lenders have varying eligibility requirements based on factors like:

- Business vintage (years in operation)

- Monthly or annual turnover

- Credit score (both business and personal)

- Type of business entity (sole proprietorship, partnership, Pvt. Ltd., etc.)

- Collateral availability (secured vs. unsecured loans)

Understanding these requirements in advance can save you time and avoid unnecessary rejections.

6. Consider Speed and Ease of Application

In today’s digital age, loan approval speed is a major factor. Fast loan processing can be a game-changer, especially when you need funds urgently. Choose a provider that offers:

- Online application and document upload

- Instant eligibility check

- Approval and disbursal within 24–72 hours

Fintech lenders often excel in this area, offering seamless digital loan journeys.

7. Transparency in Charges

Apart from the interest rate, there are other charges you need to be aware of:

- Processing fees

- Loan insurance premiums

- Foreclosure or prepayment charges

- Late payment penalties

- Legal or documentation fees

The best lenders are transparent about all these charges upfront. Always read the fine print and ask for a detailed loan agreement before signing.

8. Look for Value-Added Services

Some loan providers go beyond basic financing and offer services like:

- Dedicated relationship managers

- Loan top-up facilities

- Business advisory or mentoring

- Credit health reports and tools

These services can be especially useful for small businesses looking to grow sustainably.

9. Evaluate Customer Support

Strong customer support is often overlooked—but it’s vital. During your loan tenure, you may need help with EMI changes, statements, or repayment schedules. Choose a lender that offers:

- Responsive helplines and email support

- Local branch access (if needed)

- Online chat or WhatsApp assistance

- Clear escalation channels

Customer-centric lenders can save you from frustration down the road.

10. Match the Loan Type with Your Needs

Business loans are not one-size-fits-all. Look at what type of loan the provider offers:

- Term Loans: Fixed repayment schedule over a set tenure

- Working Capital Loans: Short-term financing for day-to-day operations

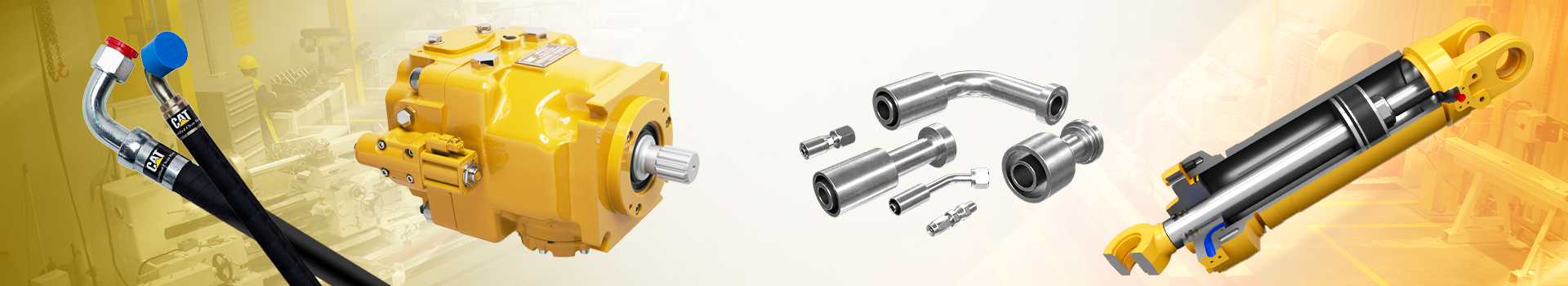

- Equipment/Machinery Loans: Specifically for asset purchases

- Invoice Financing: Loans against unpaid invoices

- Line of Credit: Flexible withdrawal with interest on used amount only

Ensure the provider offers the type of loan best suited to your needs.

11. Ask About Collateral Requirements

If you’re considering a secured business loan, check what type of collateral the lender requires—real estate, machinery, inventory, etc. Some lenders also offer unsecured loans, which are easier to obtain but may come with higher interest rates.

If your business has strong cash flow and credit history, you might be eligible for competitive unsecured loans with minimal paperwork.

12. Check for Custom Loan Solutions

Some lenders specialize in catering to certain industries—such as retail, manufacturing, healthcare, or logistics. These lenders understand your sector-specific needs better and may offer customized loan products with more favorable terms.

Ask if the loan provider offers industry-specific solutions or tailors their products based on your business model.

Final Thoughts

Selecting the best business loan provider is not just about who offers the lowest interest rate. It’s about finding a lending partner that understands your business, supports your financial needs, and offers a transparent, hassle-free borrowing experience.

For more posts, click here