In today’s digital age, businesses increasingly rely on cloud-based AI accounting software to manage their financial operations. These sophisticated systems must navigate the complex intersection of data security, privacy requirements, and financial regulations while delivering efficient accounting services. This article explores how modern AI accounting platforms protect sensitive financial data and maintain regulatory compliance.

Table of Contents

ToggleRobust Data Security Infrastructure

Multi-layered Security Architecture

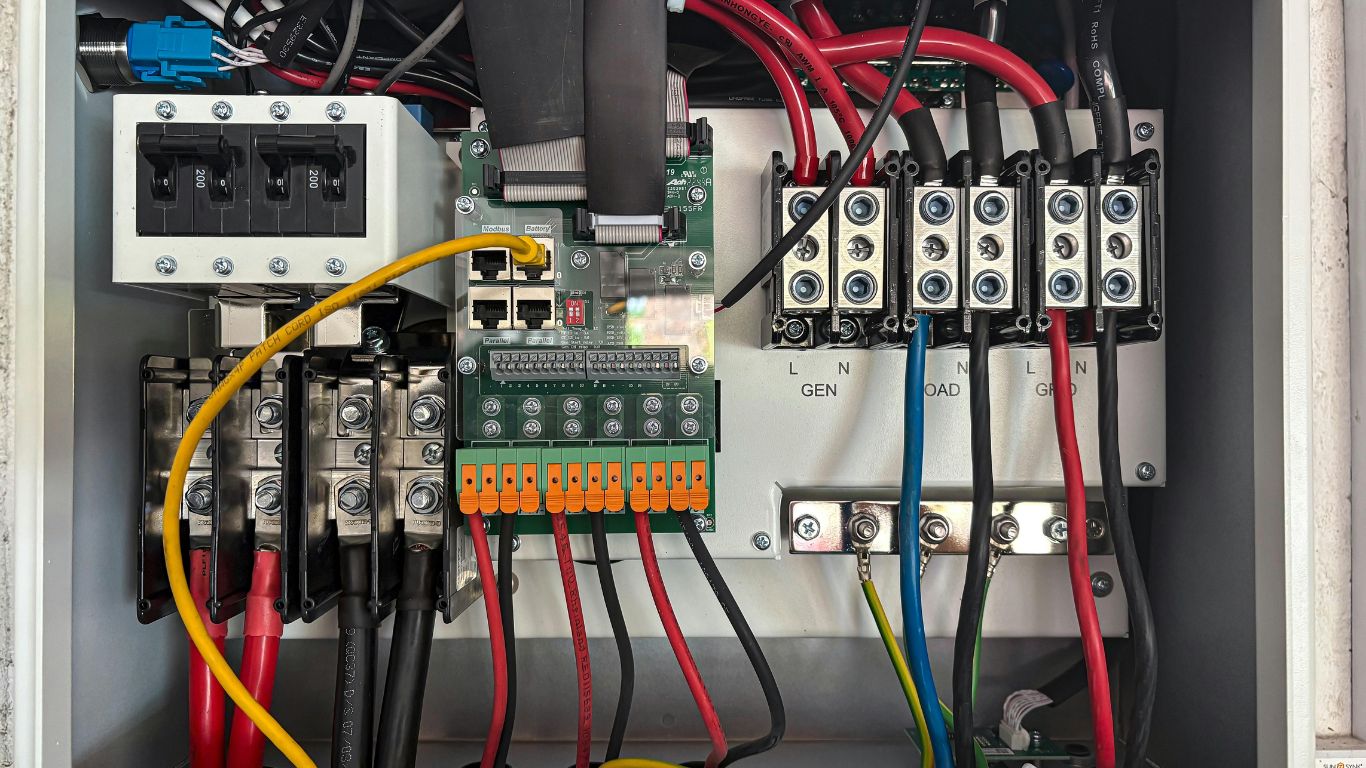

Cloud-based AI accounting software implements multiple security layers to protect financial data. This begins with physical security at data centers and extends to sophisticated digital protection mechanisms. Key security measures include:

- End-to-end encryption for data in transit and at rest

- Regular security audits and penetration testing

- Advanced firewalls and intrusion detection systems

- Real-time monitoring for suspicious activities

- Automated threat detection and response protocols

Access Control and Authentication

Modern accounting platforms employ strict access control measures to prevent unauthorized data access:

- Multi-factor authentication (MFA) for all user accounts

- Role-based access control (RBAC) to limit data visibility

- IP whitelisting and geographic access restrictions

- Session timeout and automatic logoff features

- Detailed access logs and user activity monitoring

Regulatory Compliance Framework

Financial Regulations Adherence

AI accounting software must comply with various financial regulations, including:

- Sarbanes-Oxley Act (SOX)

- Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

- Local tax regulations and reporting requirements

The software achieves this through:

- Automated compliance checking

- Regular updates to reflect regulatory changes

- Built-in validation rules for financial entries

- Standardized reporting templates

- Audit trail maintenance

Data Privacy Compliance

Modern platforms ensure compliance with data privacy regulations such as:

- General Data Protection Regulation (GDPR)

- California Consumer Privacy Act (CCPA)

- Personal Information Protection and Electronic Documents Act (PIPEDA)

This is accomplished through:

- Data minimization principles

- Privacy by design architecture

- Consent management systems

- Data retention policies

- Privacy impact assessments

AI-Enhanced Security Features

Intelligent Threat Detection

AI algorithms enhance security through:

- Pattern recognition to identify unusual transactions

- Anomaly detection in user behavior

- Predictive analytics for potential security threats

- Machine learning-based fraud detection

- Automated incident response protocols

Automated Compliance Monitoring

AI systems continuously monitor compliance through:

- Real-time transaction analysis

- Automated regulatory reporting

- Continuous control monitoring

- Risk assessment and management

- Compliance violation alerts

Data Backup and Recovery

Comprehensive Backup Systems

Cloud-based accounting software maintains data integrity through:

- Regular automated backups

- Redundant storage systems

- Geographic data replication

- Point-in-time recovery options

- Disaster recovery planning

Business Continuity

Platforms ensure continuous operation through:

- High availability architecture

- Automated failover systems

- Regular disaster recovery testing

- Business continuity planning

- Service level agreements (SLAs)

Regular Updates and Maintenance

Security Patches and Updates

Software providers maintain security through:

- Regular security patches

- Vulnerability assessments

- System updates

- Performance optimization

- Security feature enhancements

Compliance Updates

Platforms stay current with regulations through:

- Regular regulatory requirement updates

- Compliance feature additions

- Documentation updates

- User training materials

- Advisory notifications

Third-Party Validation

Security Certifications

Cloud-based accounting software maintains various certifications:

- SOC 1 and SOC 2 compliance

- ISO 27001 certification

- PCI DSS compliance (where applicable)

- Industry-specific certifications

- Security framework adherence

External Audits

Regular external validation includes:

- Independent security audits

- Compliance assessments

- Penetration testing

- Vulnerability scanning

- Risk assessments

Read Also:- Solving Cash Flow Issues with Cloud Accounting

Conclusion

Cloud-based AI accounting software ensures data security and regulatory compliance through a comprehensive approach combining advanced technology, strict protocols, and regular validation. The integration of AI enhances these capabilities, providing real-time monitoring and automated responses to potential threats while maintaining compliance with evolving regulations.

The success of these systems depends on continuous improvement and adaptation to new security challenges and regulatory requirements. As technology advances and regulations evolve, cloud-based AI accounting software must maintain its commitment to security and compliance while delivering efficient and reliable financial management services.