The Employer of Record (EOR) Services Market has experienced significant growth, driven by the increasing globalization of businesses and the need for compliance with diverse labor laws. In 2023, North America led the market, contributing approximately 45% to the global share, followed by Asia Pacific at 25%, Europe at 20%, Latin America at 6%, and the Middle East & Africa at 4%. The Aggregator Model dominated the market with a 60% share, while the Wholly Owned Infrastructure Model accounted for 40%. Small and Medium Enterprises (SMEs) were the primary users, representing 55% of the market, with Large Enterprises comprising the remaining 45%. The rise in remote work has further fueled the demand for EOR services, enabling companies to hire talent globally without establishing local entities. Additionally, the growing complexity of employment laws and the need for compliance have made EOR services a vital solution for businesses expanding internationally.

Is the Employer of Record Services Market a Strategic Investment Choice for 2025–2033 ?

Employer of Record Services Market – Research Report (2025–2033) delivers a comprehensive analysis of the industry’s growth trajectory, with a balanced focus on key components: historical trends (20%), current market dynamics (25%), and essential metrics including production costs (10%), market valuation (15%), and growth rates (10%)—collectively offering a 360-degree view of the market landscape. Innovations in Employer of Record Services Market Size, Share, Growth, and Industry Analysis, By Type (Aggregator Model, Wholly Owned Infrastructure Model), By Application (SMEs, Large Enterprises), Regional Insights and Forecast to 2033 are driving transformative changes, setting new benchmarks, and reshaping customer expectations.

These advancements are projected to fuel substantial market expansion, with the industry expected to grow at a CAGR of 6.8% from 2025 to 2033.

Our in-depth report—spanning over 107 Pages delivers a powerful toolkit of insights: exclusive insights (20%), critical statistics (25%), emerging trends (30%), and a detailed competitive landscape (25%), helping you navigate complexities and seize opportunities in the Services sector.

Global Employer of Record Services market size is anticipated to be worth USD 156.17 million in 2024 and is expected to reach USD 272.34 million by 2033 at a CAGR of 6.8%.

The Employer of Record Services market is projected to experience robust growth from 2025 to 2033, propelled by the strong performance in 2024 and strategic innovations led by key industry players. The leading key players in the Employer of Record Services market include:

- Adecco

- Randstad

- Aquent

- FoxHire

- Infotree Global

- Safeguard Global

- Velocity Global

- Globalization Partners

- Shield GEO

- Acumen International

- Remote Team (Gusto)

- Deel

- Remote Technology

- Elements Global Services

- Papaya Global

- Universal Hires

- CIIC

- Links International

- New Horizons Global Partners

- Sky Executive

Request a Sample Copy @ https://www.marketgrowthreports.com/enquiry/request-sample/108936

Emerging Employer of Record Services market leaders are poised to drive growth across several regions in 2025, with North America (United States, Canada, and Mexico) accounting for approximately 25% of the market share, followed by Europe (Germany, UK, France, Italy, Russia, and Turkey) at around 22%, and Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia, and Vietnam) leading with nearly 35%. Meanwhile, South America (Brazil, Argentina, and Colombia) contributes about 10%, and the Middle East & Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa) make up the remaining 8%.

The Employer of Record (EOR) Services Market in the Asia-Pacific (APAC) region is undergoing substantial transformation, fueled by a growing demand for flexible employment structures, international business expansion, and complex regulatory environments that necessitate expert workforce management. One of the most prominent trends in APAC is the rise of cross-border hiring, particularly by companies in developed economies such as Australia, Japan, and Singapore. These countries are increasingly leveraging talent from emerging Southeast Asian nations like Vietnam, the Philippines, and Indonesia, driven by the availability of skilled, English-speaking professionals and comparatively lower labor costs. EOR services are being utilized as a strategic mechanism to onboard this distributed talent without requiring companies to establish local entities, enabling swift and compliant expansion across the region. In addition to cross-border employment, changing labor laws across APAC are driving the adoption of EOR platforms. Governments in countries such as India, Malaysia, and South Korea are gradually embracing legislative frameworks that support remote and gig-based employment. These regulatory adjustments are fostering a favorable environment for EOR providers to deliver streamlined, compliant solutions that align with local labor expectations. Particularly in countries with intricate labor frameworks like China and India, EOR services are being recognized as essential tools to mitigate risk and maintain legal adherence.

Startups and small-to-medium enterprises (SMEs) are also emerging as key adopters of EOR solutions across the APAC landscape. With a surge in entrepreneurial activity in technology-centric hubs such as Singapore, Bangalore, and Hong Kong, young companies are turning to EOR platforms to facilitate fast market entry and to scale operations across borders without incurring the heavy burden of establishing subsidiaries or maintaining large HR departments. This trend reflects a broader regional shift toward lean, agile business practices supported by outsourced employment infrastructure. The demand for localized payroll and benefits customization is also gaining momentum across the region. Employers are increasingly seeking EOR providers that can offer not just basic hiring and onboarding services, but also localized management of payroll processing, tax deductions, statutory contributions, and employee benefits in alignment with country-specific laws. This has led to a significant evolution in EOR service capabilities, with providers building regionally adaptive solutions that accommodate the intricacies of each country’s regulatory requirements.

Another defining trend in the APAC EOR market is the integration of multilingual and culturally localized services. As companies expand into linguistically diverse markets such as Thailand, China, and Indonesia, they are expecting EOR platforms to offer interfaces and support that are tailored to local languages and cultural contexts. This development is enhancing employee satisfaction and communication efficiency in distributed teams. Finally, the acceleration of hybrid and remote work models following the pandemic has pushed companies in APAC to adopt digital-first EOR solutions. EOR providers now offer technology-enabled platforms that support remote onboarding, time tracking, and compliance management. This trend is especially prevalent in Australia, South Korea, and India, where digital infrastructure and workforce decentralization have advanced rapidly. Collectively, these evolving trends illustrate that the APAC EOR market is entering a phase of dynamic growth, characterized by compliance-driven innovation, regional adaptability, and digital transformation.

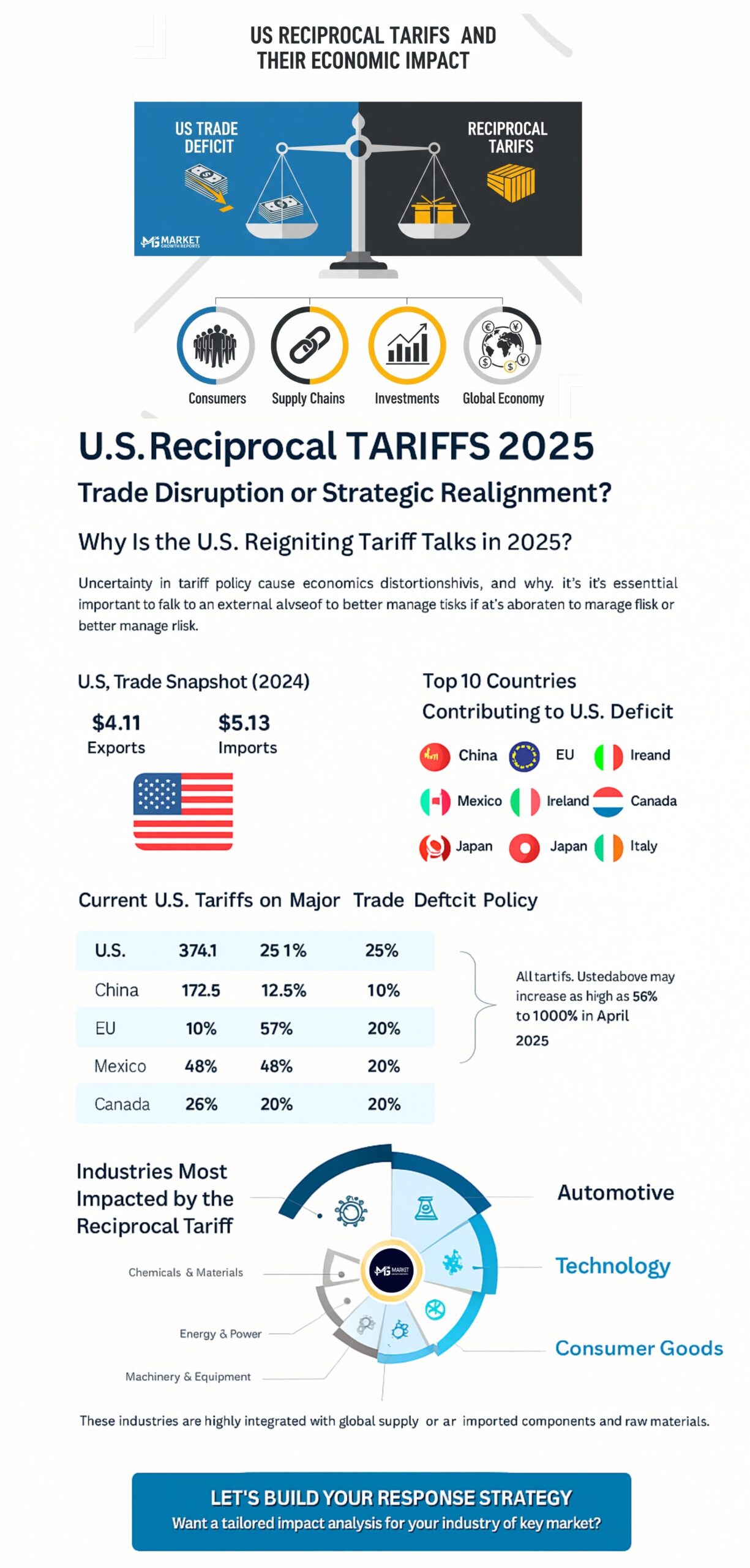

United States Tariffs: A Strategic Shift in Global Trade

In 2025, the U.S. implemented reciprocal tariffs on 70 countries under Executive Order 14257. These tariffs, which range from 10% to 50%, were designed to address trade imbalances and protect domestic industries. For example, tariffs of 35% were applied to Canadian goods, 50% to Brazilian imports, and 25% to key products from India, with other rates on imports from countries like Taiwan and Switzerland.

The immediate economic impact has been significant. The U.S. trade deficit, which was around $900 billion in recent years, is expected to decrease. However, retaliatory tariffs from other countries have led to a nearly 15% decline in U.S. agricultural exports, particularly soybeans, corn, and meat products.

U.S. manufacturing industries have seen input costs increase by up to 12%, and supply chain delays have extended lead times by 20%. The technology sector, which relies heavily on global supply chains, has experienced cost inflation of 8-10%, which has negatively affected production margins.

The combined effect of these tariffs and COVID-19-related disruptions has contributed to an overall slowdown in global GDP growth by approximately 0.5% annually since 2020. Emerging and developing economies are also vulnerable, as new trade barriers restrict their access to key export markets.

While the U.S. aims to reduce its trade deficit, major surplus economies like the EU and China may be pressured to adjust their domestic economic policies. The tariffs have also prompted legal challenges and concerns about their long-term effectiveness. The World Trade Organization (WTO) is facing increasing pressure to address the evolving global trade environment, with some questioning its role and effectiveness.

About Us: Market Growth Reports is a unique organization that offers expert analysis and accurate data-based market intelligence, aiding companies of all shapes and sizes to make well-informed decisions. We tailor inventive solutions for our clients, helping them tackle any challenges that are likely to emerge from time to time and affect their businesses.