Introduction

Texas is renowned for its vast natural resources, especially oil and gas. With its history rooted in energy production, the state continues to offer abundant opportunities for investors seeking mineral rights. Whether you’re an experienced investor or exploring this field for the first time, discovering mineral rights for sale in Texas can lead to long-term financial growth. Understanding how the process works, what to look for, and where to buy can help you make well-informed decisions.

What Are Mineral Rights?

mineral rights for sale texas refer to the legal authority to explore, extract, and profit from underground resources such as oil, gas, and other valuable minerals. In the United States, land ownership can be divided into surface rights and mineral rights. Texas allows mineral rights to be sold or leased separately from the surface property. This means that even if someone owns the land, another party may own the rights to what lies beneath.

Buying mineral rights gives the investor access to any financial gains from the extraction and sale of those resources. These rights can be sold outright or leased to energy companies for a royalty-based return.

Why Texas Is a Prime Location

Texas leads the U.S. in energy production and exploration. Its geology is rich with oil and gas reserves, particularly in regions such as:

-

Permian Basin: Located in West Texas, the Permian Basin is one of the most prolific oil-producing areas in the world.

-

Eagle Ford Shale: Situated in South Texas, this area has seen rapid development in natural gas and oil production.

-

Barnett Shale: Located in North Texas, the Barnett Shale is one of the oldest and most developed shale gas fields.

The combination of modern drilling techniques and rich resource deposits makes Texas an ideal state for purchasing mineral rights.

Types of Mineral Rights Transactions

When looking to invest in mineral rights, there are two primary types of transactions:

-

Outright Purchase: Buying the mineral rights means full ownership, including all future royalties and lease agreements. This option can be more expensive but potentially more lucrative in the long run.

-

Leasing Mineral Rights: In a lease agreement, you retain ownership but allow a third party—typically an oil and gas company—to explore and extract resources. In return, you receive a royalty percentage from the production revenue.

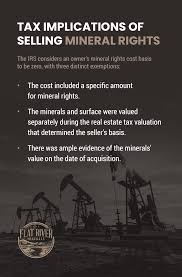

Each type of transaction has different tax implications and risks. It’s essential to understand both before making a purchase.

Factors to Consider Before Buying

Before purchasing mineral rights in Texas, consider these important factors:

-

Location and Production History: Areas with proven production or ongoing development offer a higher likelihood of returns.

-

Current Leases: Some mineral rights are already leased to energy companies. Check the lease terms, royalty rates, and expiration dates.

-

Title Verification: Ensure that the seller has a clear and marketable title to the mineral rights. Title issues can delay or invalidate a sale.

-

Royalty Percentages: If leasing is part of your plan, higher royalty percentages can improve your long-term income.

-

Market Conditions: Oil and gas prices fluctuate. Economic and geopolitical factors can affect your investment’s profitability.

It’s highly advisable to consult a mineral rights attorney or a landman (a professional who deals in land and mineral transactions) before making any final decisions.

How to Find Mineral Rights for Sale

There are several ways to find mineral rights for sale in Texas:

-

Online Marketplaces: Websites like MineralWise, EnergyNet, and US Mineral Exchange list available rights for sale with relevant data and pricing.

-

Broker Services: Professional brokers specialize in connecting buyers and sellers of mineral rights. They often have access to exclusive listings and can assist with negotiations.

-

County Records: Some mineral rights can be discovered through county clerk offices or property record databases. This method requires more research but can lead to unique opportunities.

-

Direct Outreach: Some investors write directly to landowners in promising geological areas expressing interest in purchasing their mineral rights.

Benefits of Owning Mineral Rights

Owning mineral rights in Texas offers numerous potential advantages:

-

Steady Passive Income: If leased to energy companies, mineral rights can generate royalty income without the owner having to manage operations.

-

Appreciation Potential: As oil and gas prices rise or new technology unlocks harder-to-reach resources, your investment could grow in value.

-

Portfolio Diversification: Adding mineral rights to your investment portfolio diversifies your income sources and spreads risk.

-

Resale Opportunity: Mineral rights can be sold at a profit if market demand increases or new drilling opportunities arise.

Risks and Considerations

While mineral rights can be lucrative, they also come with potential risks:

-

Price Volatility: Oil and gas prices can swing dramatically due to market trends, affecting your royalty income.

-

Environmental Issues: Drilling operations can sometimes lead to environmental disputes or liabilities, even if you don’t own the surface land.

-

Legal Complexity: Understanding lease terms, tax obligations, and property law can be challenging without proper legal guidance.

To mitigate these risks, thorough research and due diligence are essential.

Conclusion

The market for mineral rights in Texas offers a promising investment path for those looking to tap into the energy sector. From the resource-rich Permian Basin to emerging shale plays, opportunities abound for savvy investors. However, it’s important to approach the market with clear knowledge, sound legal advice, and a long-term investment mindset.

By understanding what mineral rights entail, how the Texas market works, and the key considerations before buying, you can position yourself for success. Explore the many options available and start your journey toward owning mineral rights in one of the world’s leading energy-producing states.