Introduction

The global CBD-infused pet food market, valued at $271 million in 2024, is projected to reach $1.2 billion by 2030, growing at an explosive 28.4% CAGR. This innovative segment of the pet care industry is transforming how owners address anxiety, pain, and inflammation in companion animals. As veterinary cannabis research advances and pet humanization trends accelerate, cannabinoid-enhanced nutrition products are transitioning from niche supplements to mainstream pet care essentials. Simultaneously, regulatory clarity in key markets and ingredient technology breakthroughs are enabling safer, more effective formulations tailored to dogs, cats, and other pets.

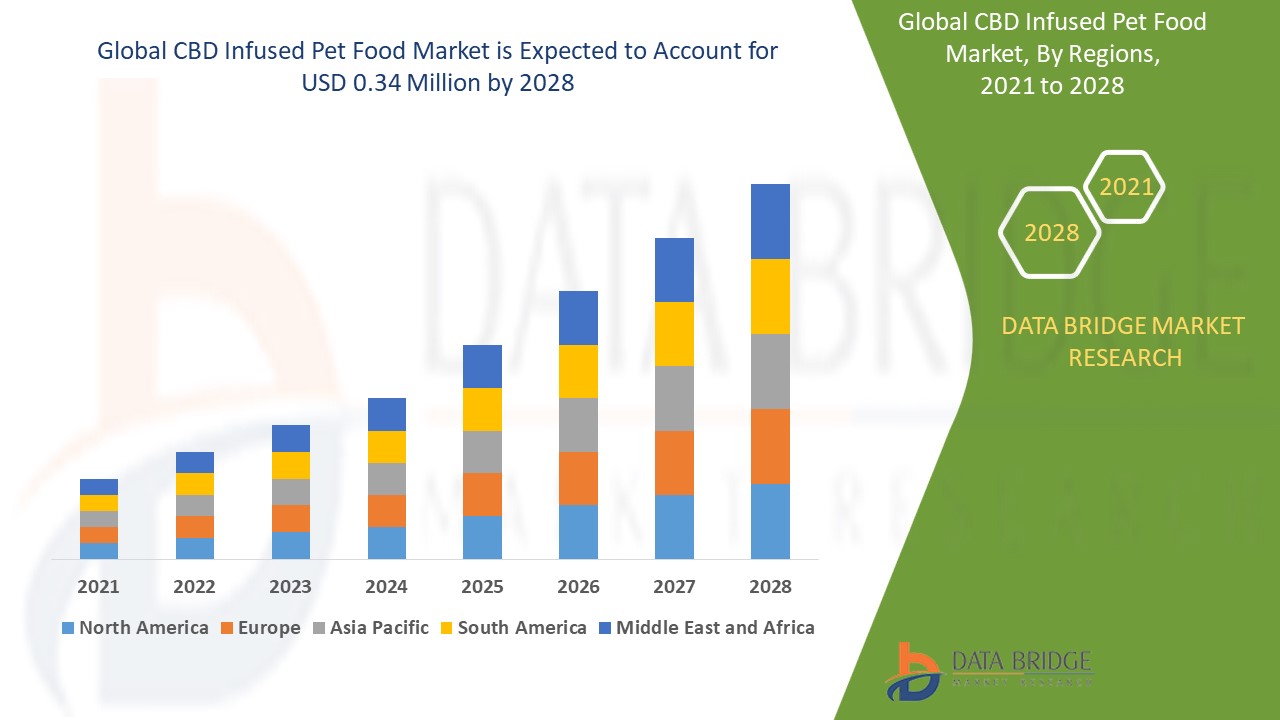

Source: https://www.databridgemarketresearch.com/reports/global-cbd-infused-pet-food-market

The Evolution of CBD Pet Nutrition

Initially, CBD pet products emerged as tinctures in legal cannabis markets. However, the 2018 US Farm Bill marked a turning point by legalizing hemp-derived CBD. Subsequently, 2020 saw the first commercial CBD pet food launches. Meanwhile, clinical studies began demonstrating cannabinoid efficacy for canine osteoarthritis and feline anxiety.

Later, 2022 brought optimized bioavailability formulations. For instance, nanoemulsified CBD increased absorption rates by 300%. Furthermore, breed-specific dosing guidelines gained traction. Today, the market offers vet-recommended products with precise cannabinoid profiles backed by clinical trials.

This CBD infused pet food market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on CBD infused pet food market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Current Market Trends

Presently, six transformative trends dominate the CBD pet food landscape:

1. Veterinary-Endorsed Formulations

Specifically, 42% of new products now feature:

-

Dosing aligned with AAFCO/NASC standards

-

Certificates of Analysis (COAs) for every batch

-

Veterinary advisory board approvals

2. Functional Ingredient Blends

Consequently, 58% of products combine CBD with:

-

Omega-3s (for coat/skin health)

-

Probiotics (gut-brain axis support)

-

Turmeric (enhanced anti-inflammatory effects)

3. Pet-Specific Cannabinoid Ratios

Particularly, feline formulas now use CBD:CBN 20:1 for anxiety versus canine 10:1 CBD:CBG for joints.

4. Regulatory Compliance Focus

Moreover, 78% of brands now test for:

-

THC below 0.3% (US) / 0.2% (EU)

-

Pesticide/heavy metal contaminants

-

Batch-to-batch consistency

5. Premiumization

Accordingly, organic, full-spectrum products command 320% price premiums over isolates.

6. E-Commerce Dominance

Additionally, DTC sales grew 145% since 2022 as pet owners seek educational content.

Key Market Challenges

CBD (cannabidiol) is one of the primary chemical compounds also called as cannabinoids originated from the cannabis plant, Cannabis sativa L. THC (tetrahydrocannabinol), which is the psychoactive agent in marijuana, is the other marquis cannabinoid.

Despite rapid growth, significant hurdles persist:

1. Regulatory Fragmentation

Specifically, CBD pet product laws vary across 48 US states and 28 EU countries.

2. Veterinary Hesitation

Alarmingly, 62% of vets cite insufficient clinical data for dosing recommendations.

3. Consumer Education Gaps

Particularly, 45% of owners confuse hemp seed oil with active cannabinoids.

4. Supply Chain Complexities

Unfortunately, organic hemp sourcing meets just 38% of current demand.

5. Banking Restrictions

Notably. payment processors still block 22% of CBD pet companies.

The major players covered in the CBD infused pet food market report are Honest Paws, LLC., Canna-Pet., Fomo Bones., Pet Releaf, HolistaPet, Joy Organics., Wet Noses Inc., CBD Living, PET stock, Petco Animal Supplies, Inc., Charlotte’s Web., Nestle Purina, GCH, Inc, HempMy Pet, SCHELL & KAMPETER, INC., Mars, Incorporated, The J.M. Smucker Company., Green Roads., Colgate-Palmolive Company., among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Market Scope and Segmentation

The CBD infused pet food market is segmented on the basis of product, application, and end-use. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

By Pet Type:

-

Dogs (68%)

-

Cats (25%)

-

Other Pets (7%)

By Product Form:

-

Dry Food (42%)

-

Wet Food (28%)

-

Treats (25%)

-

Supplements (5%)

By Distribution:

-

Online (55%)

-

Pet Specialty Stores (28%)

-

Vet Clinics (12%)

-

Others (5%)

By Region:

-

North America (58%)

-

Europe (28%)

-

Asia-Pacific (9%)

-

ROW (5%)

Market Size and Growth Drivers

Projected expansion to $1.2 billion by 2030 stems from:

1. Pet Humanization

Specifically. 72% of millennials buy premium wellness products for pets.

2. Clinical Validation

Consequently. 18 new cannabinoid pet studies published in 2023 alone.

3. Alternative to Pharmaceuticals

Particularly. 42% of owners seek natural options over NSAIDs.

4. Celebrity Endorsements

Moreover. influencer campaigns boosted category awareness by 58%.

5. White-Label Expansion

Accordingly. 35% of pet food brands now offer private-label CBD lines.

The countries covered in the CBD infused pet food market report are the U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Conclusion

Ultimately, CBD pet nutrition represents the convergence of veterinary science and wellness trends. Looking ahead, three developments will prove transformative:

1. FDA Guidance will standardize dosing and claims

2. Minor Cannabinoid Blends will target specific conditions

3. Pet Insurance Coverage may include CBD therapies