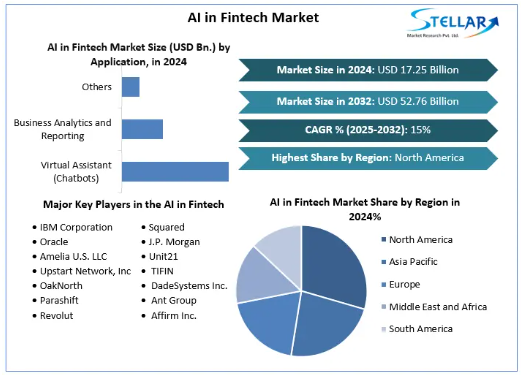

AI in Fintech Market size was valued at USD 17.25 Billion. in 2024 and the total Global AI in Fintech Market revenue is expected to grow at a CAGR of 15 % from 2025 to 2032, reaching nearly USD 52.76 Billion.

Market Estimation & Definition

Market Definition

The AI in Fintech market encompasses artificial intelligence technologies and solutions—including frameworks, platforms, cloud deployments, and embedded services—that enable financial institutions and fintech firms to automate, analyze, and personalize operations across services like fraud management, credit scoring, process automation, and customer support.

Market Estimation

By 2031, the global AI in Fintech market is projected to reach approximately USD 47.54 billion, demonstrating strong growth momentum. Leading technology providers currently control over half of the total market share, with mid-tier and niche players also carving out space through specialized offerings.

Market Growth Drivers & Opportunities

Key Growth Drivers

-

Fraud Detection & Compliance: AI’s ability to process massive datasets in real time allows institutions to detect and block fraudulent activity with high accuracy, reducing both financial loss and operational friction.

-

Personalization & Risk Assessment: AI-powered systems enable dynamic credit scoring, personalized product recommendations, and improved customer service—enhancing satisfaction while widening financial inclusion.

-

Generative AI & Efficiency Leap: The adoption of generative AI is projected to increase operational efficiency in banking by nearly 46%, transforming workflows, fraud prevention, and client engagement.

-

Investment Surge: Billions of dollars have been invested in AI-enabled fintech solutions, reflecting strong confidence in its long-term role in financial services.

-

Geographic Momentum: Mature markets in North America and Europe are driven by innovation and compliance, while Asia-Pacific markets benefit from expanding digital infrastructure and supportive policy frameworks.

Market Opportunities

-

Cloud-Based Scalability: Cloud deployment offers cost efficiency and speed, making AI tools accessible for both large institutions and smaller fintech startups.

-

SME Integration: Affordable AI-as-a-service platforms are enabling smaller enterprises to implement sophisticated fraud detection, customer analytics, and process automation without heavy infrastructure costs.

-

Regulatory Alignment Solutions: AI tools designed to help institutions meet compliance standards create new product categories and service lines.

Segmentation Analysis

By Service Type

-

Frameworks – Infrastructure and compliance-oriented solutions for model building and deployment

-

Platforms – Ready-to-use AI applications for fraud detection, analytics, and credit modeling

By Deployment Model

-

Public Cloud – The dominant model, offering scalability and lower upfront costs

-

Private Cloud – Favored where data privacy and sovereignty are paramount

-

Hybrid Cloud – Blends flexibility with enhanced control over sensitive processes

By Organization Size

-

Large Enterprises – Leaders in AI adoption due to resources and data availability

-

SMEs – Emerging adopters leveraging SaaS and pay-as-you-go AI models

By Vertical

-

Banking, Financial Services & Insurance (BFSI) – The largest segment

-

Retail & Consumer Goods

-

Healthcare

-

Manufacturing

-

Telecom and Others

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Middle East & Africa

-

Latin America

Country-Level Analysis: USA & Germany

United States

The U.S. commands roughly 39% of the global AI in Fintech market. Adoption is driven by strong fintech innovation hubs, robust cloud infrastructure, and advanced use cases such as predictive credit scoring, robo-advisory platforms, and AI-enhanced fraud detection. Financial giants and agile startups alike are deploying AI to increase operational efficiency, enhance customer trust, and deliver hyper-personalized financial products.

Germany

Germany stands as one of Europe’s most advanced AI in Fintech markets, backed by strong regulatory frameworks like PSD2 and the EU’s General Data Protection Regulation. Adoption is focused on compliance-ready solutions, advanced analytics, and AI-powered banking platforms. The country’s fintech growth is supported by both established financial institutions modernizing their systems and startups innovating with open banking capabilities.

Competitive (“Commutator”) Analysis

Market Structure

The AI in Fintech landscape is tiered:

-

Tier 1: Global tech leaders providing infrastructure and end-to-end AI solutions.

-

Tier 2: Specialized technology providers focusing on fraud prevention, risk assessment, and customer analytics.

-

Tier 3: Startups innovating rapidly in areas like generative AI, embedded finance, and industry-specific automation.

Porter’s Five Forces Summary

-

Threat of New Entrants: Moderate. Cloud AI tools lower technical barriers, but trust, compliance, and integration complexity remain challenges.

-

Competitive Rivalry: High. Large players compete on breadth of offerings, while smaller firms differentiate through niche specialization.

-

Threat of Substitutes: Present. Legacy systems and non-AI fintech tools still meet some operational needs, but are increasingly less competitive.

-

Bargaining Power of Buyers: Growing. Enterprises can easily compare and trial AI solutions before committing.

-

Bargaining Power of Suppliers: Moderate. Data, algorithms, and computing power are essential, but global availability limits supplier dominance.

Discover What’s Trending :

Conclusion

The AI in Fintech market is on track for exceptional growth, with a projected value exceeding USD 47 billion by 2031. This momentum is driven by innovations in fraud detection, customer personalization, generative AI applications, and compliance automation.

The United States will remain the innovation epicenter, while Germany exemplifies successful integration under stringent regulatory frameworks. Asia-Pacific will continue its rise as digital transformation accelerates across emerging economies.

For market participants, the path to success lies in:

-

Developing vertical-specific AI tools that address unique sector challenges

-

Building transparent, ethical AI models to meet evolving regulatory expectations

-

Leveraging cloud scalability to democratize AI access for organizations of all sizes

-

Using partnerships and acquisitions to expand technical capabilities and market reach

As AI becomes embedded across the financial ecosystem, its ability to reduce risk, enhance service quality, and unlock new revenue streams will redefine how financial services operate and compete in the coming decade.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656