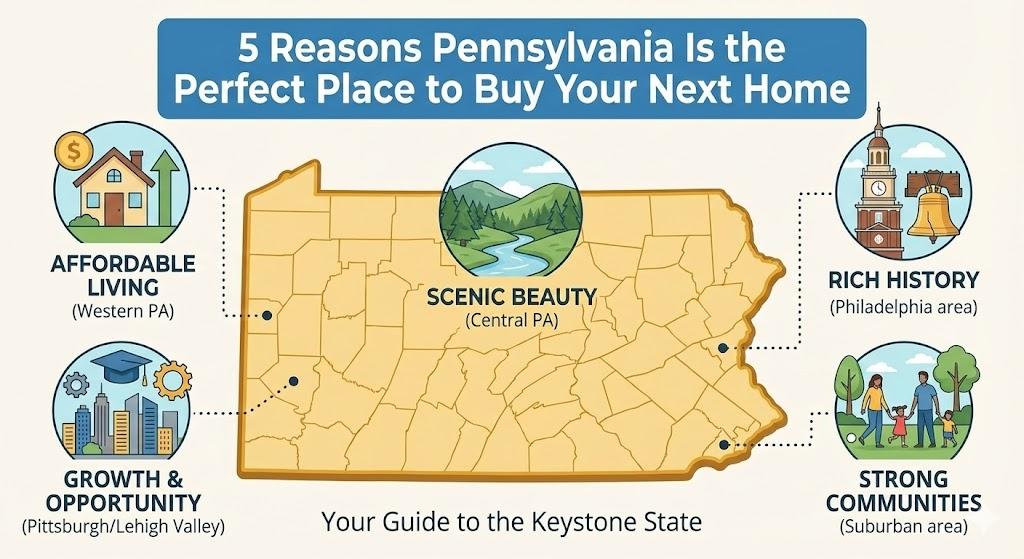

If you’re browsing homes for sale in Pennsylvania, you’re already on the right track. From approachable prices to incredible lifestyle variety, the Keystone State delivers strong long-term value for first-time buyers, move-up homeowners, and relocation shoppers alike. Below, we break down five big reasons PA is a smart buy—and how to find the right residential property for sale Pennsylvania buyers are competing for right now.

Reason 1: You Get More Home for Your Money

Compared with many coastal and Sun Belt markets, Pennsylvania’s median home prices are typically well below the national median. That can translate to lower monthly payments, easier down payments, and the ability to buy in established neighborhoods without sacrificing space or features.

What this means for buyers:

- Better price-per-square-foot across most regions

- Room to prioritize outdoor space, garages, or home offices

- Opportunity to target move-in-ready homes instead of heavy fixer-uppers

Where value shows up:

- Pittsburgh area: Charming brick homes and revitalized neighborhoods with strong amenities

- Lehigh Valley (Allentown–Bethlehem–Easton): Suburban single-family homes with commuter access

- Central PA (Harrisburg, Lancaster, York): Quiet streets, historic homes, and new construction options

- Greater Philadelphia suburbs (Montgomery, Bucks, Chester, Delaware): Diverse price points and top school districts

Tip: Pair a sharp pre-approval with automated alerts for your target price band. Fast-moving homes for sale in Pennsylvania tend to go pending quickly when they’re well-priced and well-presented.

Reason 2: A Home Style for Every Lifestyle

Pennsylvania’s housing stock is remarkably diverse—city rowhomes, suburban colonials, modern townhomes, historic farmhouses, mountain cabins, lake homes, and everything in between.

Highlights by lifestyle:

- Urban energy: Philadelphia and Pittsburgh neighborhoods with walkability, transit, arts, and dining

- Suburban comfort: Blue-ribbon school districts, cul-de-sacs, and parks across the Philly and Pittsburgh metros

- Small-city charm: Lancaster, Bethlehem, State College, and West Reading blend character with convenience

- Mountain and lake retreats: Poconos, Laurel Highlands, and Lake Wallenpaupack for four-season fun

- New construction: Master-planned communities across the state with modern layouts and energy efficiency

Why that matters:

- You can buy for your season of life—starter condo, growing-family SFH, or downsize-ready townhome

- Diverse options help you balance budget, commute, and amenities without leaving the state

Reason 3: Stable Job Centers and Top-Tier Education/Healthcare

Pennsylvania’s economy is anchored by healthcare systems, universities, finance, logistics, manufacturing, and tech—industries that help stabilize housing demand.

Demand drivers you’ll feel as a homeowner:

- Major health networks and universities create year-round employment

- Corporate hubs and logistics corridors along I-76, I-80, I-81, and I-95 support long-term growth

- Strong school districts and higher education options add durable neighborhood appeal

Translation: When you buy, you’re not just getting a house—you’re investing in a region with resilient demand fundamentals.

Also Read: FHA Mortgage Solutions for Easy and Affordable Home Financing

Reason 4: Everyday Convenience Meets Weekend Adventure

PA offers the best of both worlds: daily convenience and quick access to the outdoors.

Connectivity:

- Roads: Pennsylvania Turnpike (I-76), I-80, I-81, I-83, I-79, I-95, Route 422 and more

- Rail: Amtrak Keystone Service (Harrisburg–Lancaster–Philadelphia–NYC) and Pennsylvanian (Pittsburgh–Philly–NYC); regional transit via SEPTA and Port Authority

- Air: Major airports at Philadelphia (PHL) and Pittsburgh (PIT), plus Allentown (ABE), Harrisburg (MDT), and others

Lifestyle:

- Four true seasons with hiking, skiing, biking, lakes, and trails (hello, Appalachian Trail)

- Pro sports, live music, museums, and thriving restaurant scenes

- Historic main streets and local festivals in communities across the state

Whether you want walkable city blocks or a quiet cul-de-sac, you’ll find daily ease—and weekend escapes—in easy reach.

Reason 5: Buyer-Friendly Programs and Ownership Benefits

Pennsylvania offers a suite of programs that can make buying more accessible.

What to explore:

- PHFA (Pennsylvania Housing Finance Agency) programs: Competitive loans, down payment and closing cost assistance, and forgivable second-loan options (e.g., K-FIT). Eligibility varies—ask your lender.

- Local grants: Some cities and counties offer first-time buyer grants and employer-assisted housing benefits.

- Homestead Exemption: Primary-residence tax relief programs may reduce your taxable assessment; specifics vary by municipality.

- New construction warranties and energy savings: Many builders offer multi-year coverage and high-efficiency systems that curb long-term costs.

The bottom line: Your up-front cash and monthly costs may be lower here than you expect—especially when you stack the right programs.

Where to Start Your Search for Homes for Sale in Pennsylvania

Use these strategies to lock in the right fit fast:

- Map your lifestyle: List must-haves (commute, school district, yard, walkability) and rank them.

- Set intelligent alerts by creating saved searches for “homes for sale in Pennsylvania” at your price, bed, and bath levels within preferred zip codes.

- Ask your agent to show you “coming soon” properties, new communities, and builder incentives so you do not miss any off-market or new construction deals.

- Value zones are neighborhoods with good fundamentals where the days on market at your price point is relatively low. This is where you should focus and negotiate hard.

- Search like a pro: If you’re typing “residential property for sale Pennsylvania” into portals, add filters for lot size, HOA fees, and year built to save time.

Quick region snapshot

Region/Metro |

What buyers love |

Typical property types |

Greater Philadelphia

|

Transit, culture, top schools, suburbs

|

Rowhomes, twins, colonials, new builds

|

Pittsburgh & suburbs

|

Neighborhood charm, tech/healthcare jobs

|

Brick SFH, townhomes, historic homes

|

Lehigh Valley

|

Commutable to NYC/Philly, suburban value

|

Newer SFH, townhomes, 55+

|

Central PA (HBG/Lanc/York)

|

Quaint towns, farmland views, affordability

|

Historic SFH, farmhouses, new communities

|

Poconos & Highlands

|

Four-season recreation and retreats

|

Cabins, chalets, lake homes

|

Note: Pricing and availability change quickly—verify current comps with your agent.

The Pennsylvania Buying Process: What to Expect

- Pre-approval first: Strengthen your offer and set a realistic budget.

- Tours and offers: Make quick offers on well-priced homes. Be flexible with terms if possible.

- Inspections: General home, termite/wood destroying insect and radon are common. Septic/well testing if not on public utilities.

- Appraisal and title: Lender orders appraisal. Title company runs searches and coordinates closing.

- Municipalities: A few require a resale/Use & Occupancy inspection-who handles this? Make sure your contract addresses it.

- Closing costs: Transfer tax (commonly about 2% total in most areas, typically split buyer/seller; higher local rates in some cities, such as Philadelphia), title fees and lender costs. Get them to give you an itemized estimate up front.

- Timeline: Cash purchases can close quickly; financed deals often take 30–45 days.

Here is a pro tip: More often than not, sellers will go for fully clean and completed offers with strong earnest money deposits-and, of course, reasonable contingencies even if they are not the highest offer.

FAQs: Buying a Home in Pennsylvania

Q: Is Pennsylvania rated high among first-time homebuyers?

A: Yes-very much affordable compared to other states, wide range of housing stock available, and PHFA assistance options.

Q: How competitive is the market?

A: Desirable homes under local medians can go fast. Get pre-approved and be ready to tour quickly when new listings hit.

Q: Do I need a real estate attorney to buy in PA?

A: An attorney is not required because, in most residential transactions, it is the title company that conducts the closing. However, some clients feel more comfortable engaging an attorney to review documents and attend closing on their behalf.

Q: What inspections are common in PA?

A: General home inspection, radon inspection, and termite or wood destroying insect (WDI) inspection. In a rural or exurban area- septic and well water testing.

Q: What are typical closing costs for buyers?

A: Budget for your share of transfer tax, title insurance and fees, lender costs, prepaids/escrows, and inspections. Have your lender and title partner provide a customized estimate.

Q: Are property taxes high in Pennsylvania?

A: They vary by county and municipality. Even where tax rates are higher, lower home prices often keep total monthly costs competitive. Ask your agent to pull estimated taxes for each property.

Ready to find your home?

Explore current homes for sale in Pennsylvania and get a custom list that matches your budget, commute, and must-haves. Reach out to the Covelliticica team for a personalized search, neighborhood insights, and on-call showing support—so you can move from browsing to moving with confidence.